Amendment of KSeF regulations

Due to capacity problems that prevented the introduction of mandatory e-invoicing through the National E-invoicing System (KSeF) within the originally planned timeframe, it became necessary to postpone its implementation, as mentioned during the consultations on the KSeF.

On 5 November this year, a draft amendment to the Act was published on the website of the Government Legislation Centre, introducing changes to the mandatory use of e-invoicing. The bill and its explanatory memorandum include a number of important changes that resulted from the consultations, as well as additional changes that may come as a surprise to taxpayers. The amendment to the Act is expected to be published in Q1 2025.

In this alert, we provide the latest information from the published bill and explanatory memorandum that will affect the operation of the KSeF.

STAGED IMPLEMENTATION OF KSEF

The bill reiterates that the KSeF will be implemented in two stages, affecting different groups of taxpayers:

- From 1 February 2026, the obligation will apply to taxpayers with revenues exceeding PLN 200 million in 2025.

- From 1 April 2026, KSeF will be mandatory for other taxpayers.

BUYER’S OBLIGATION TO PROVIDE TAX IDENTIFICATION NUMBER

The bill further specifies the buyer’s obligation to provide their TIN when issuing an invoice for business purposes. Importantly, however, the current wording of the legislation does not sanction the buyer’s failure to provide the TIN, which is a departure from the original concept of “self-identification” proposed by the Ministry of Finance at the consultation stage.

VOLUNTARY USE OF OFFLINE MODE

Traders will be allowed to voluntarily use the offline mode until the end of 2026, which means that it will be possible to issue e-invoices outside the KSeF system, provided that the invoice is sent to the KSeF on the next working day after it is issued.

After the transition period, ‘offline’ mode will also be allowed, but only in certain situations such as breakdowns.

SIMPLIFICATION FOR MICRO-ENTERPRISES

Between April and September 2026, micro-enterprises will be allowed to issue paper invoices and e-invoices for transactions of up to PLN 450 (on a one-off basis) if the total value of sales to be documented by such invoices does not exceed PLN 10,000 per month.

VOLUNTARY ISSUANCE OF CONSUMER E-INVOICES

The bill provides for voluntary issuance of e-invoices to consumers. The decision on how to issue an invoice (a traditional one or an e-invoice) can be made by the issuer himself, with no need to obtain the buyer’s consent. However, the issuer will be obliged to provide access to the e-invoice in the KSeF system through the anonymous access as described below.

ANONYMOUS ACCESS TO E-INVOICES

The bill provides that in relation to a buyer who does not use his TIN or VAT number for invoicing, the issuer of the invoice shall provide the buyer with access to that invoice, either by providing a code to verify such an invoice and identification data, or by marking it with a QR code allowing access to that invoice in the KSeF.

SUMMARY IDENTIFIER FOR E-INVOICES

A taxpayer who makes payments for more than one e-invoice will have the option to identify payments made to more than one customer.

ATTACHMENTS TO E-INVOICES

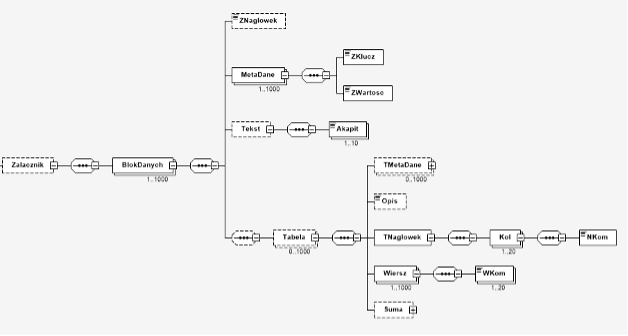

The functionality of sending attachments, although it will not be mandatory, has been designed mainly for traders who need to send attachments to framework or collective invoices. As stated in the explanatory memorandum to the bill, the data contained in the invoice attachments will be in a structured form, which will make it easier to process and analyze the information.

At the same time, taxpayers will have the flexibility to define the content of certain boxes, which will make it possible to adapt the data to the specific needs of the sector. In practice, an attachment will consist of up to 1,000 additional data blocks, each of which can be described by the taxpayer using text or tables (tables will also be textual).

CERTIFICATES FOR QR CODES

Before KSeF becomes mandatory, taxpayers will have the option to generate and download invoice issuer certificates in advance. The certificates will be required for invoicing in the system, as well as in the event of failure or unavailability of the KSeF, or if the taxpayer decides to temporarily issue invoices outside the system.

The installation of the certificates will be available no earlier than 1 November 2025, and the technical issues related to their generation and uploading will be defined in the “Interface Specification of the National e-Invoicing System (KSeF)”.

ALIGNMENT OF KSeF PRODUCTION ENVIRONMENTS

In Q4 2025, the current optional KSeF system will be replaced with a mandatory version in the production environment (i.e. the environments will be aligned so that the optional version should have similar functionalities to the version that will be mandatory from February 2026).

By implementing these solutions before the deadline, taxpayers will have the opportunity to test the software and familiarize themselves with the new features that will apply after 1 February 2026.

At the same time, from the point of view of a user already using KSeF, once the KSeF environments are aligned, the invoicing process will not change during the period of use of the optional system, as new functionalities, such as the generation of collective payment identifiers, will not yet be required.

REQUIREMENT TO PROVIDE TIN FOR LOCAL GOVERNMENT UNITS

In line with the new changes, in order to provide access to invoices to subordinate local government units, the requirement to provide the TIN of the subordinate local government unit on the invoice will be introduced. To this end, a change to the e-invoice schema is proposed to make it mandatory to fill in the ‘Entity3’ field. This change is intended to implement the postulates of local self-government units regarding the improvement of access to invoices for their subordinate units.

POSTPONED REQUIREMENTS

In addition, the bill provides for the continuation until 31 July 2026 of:

- the postponement of the requirement to indicate the KSeF number in payments for invoices, even in the case of payments under the split payment mechanism;

- the deadline for the abolition of simplified invoices (after the introduction of KSeF);

- the postponement of the deadline for penalties for non-compliance with KSeF requirements.

CASH REGISTER ACCESS TO DATA IN KSeF

The bill extends access to e-invoices in the KSeF to authorities of the National Tax Administration (KAS), such as the Minister of Finance, the head of the KAS or the heads of tax offices, for the purpose of performing their statutory duties. Access is also granted to other institutions, such as the Inspector General of Financial Information, courts, the Public Prosecutor’s Office or the Office for Competition and Consumer Protection.

In addition, the data provided to these authorities will be marked as “fiscal secret” and transmitted in accordance with the procedures for the protection of classified information.

KONTAKT

E: aleksandra.kalinowska@pl.Andersen.com

T: +48 22 690 08 70

M: +48 724 440 693

E: elzbieta.lis@pl.Andersen.com

T: +48 32 731 68 58

M: +48 664 948 038