General ruling on VAT settlement in transactions made with fuel cards

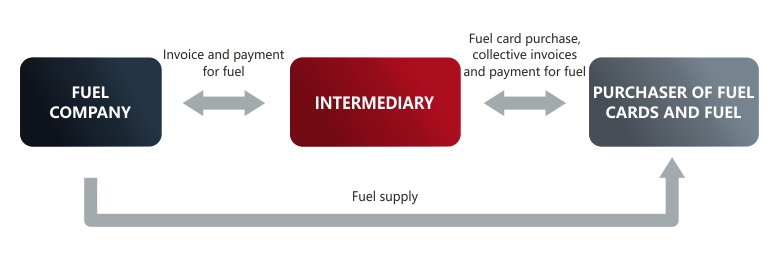

On 15 February 2021, the Ministry of Finance issued a general ruling on the VAT effects of transactions made using fuel cards. The ruling applies to situations where one of the entities (leasing provider, parent company) provides fuel cards to another entity, while not being their issuer. The second entity (the lessee) uses the fuel cards and purchases fuel from the supplier (e.g. a fuel station) which is the third entity in the three-partite model.

The problem relating to the use of such a model is whether the supply of fuel involving a fuel card should be treated as provision of services (Art. 8(1) of the VAT Act) or as supply of goods to the recipient (Art. 7(1) of the VAT Act).

According to the general ruling, a transaction made with the use of a fuel card in the above manner should be classified as provision of services if:

- the fuel is purchased by the recipient (card holder) directly from suppliers who operate fuel stations,

- only the recipient decides about the manner of fuel purchase (selection of the place of purchase), the quantity and quality of the fuel, the moment of purchase and the manner of its use,

- the recipient (with the exclusion of the intermediary) incurs all costs of fuel purchase,

- the intermediary’s role is limited to providing the recipient with access to a financing instrument (the fuel card) which enables the purchase.

If all of the above requirements are satisfied, the activities of the entity intermediating between the supplier and the recipient of the goods, which consist of making fuel cards accessible, should be classified as provision of services to the latter. These will be services of financing exempt from VAT, which means that the recipient will not be entitled to deduct the tax.

In the general ruling, the Head of KAS refers to statements made in the judgments issued in cases C-235/18 Vega International and C-185/01 Auto Lease Holland.

Consequences for individual rulings issued previously

It bears emphasizing that on 1 January 2021 the provision of Art. 7(8) of the VAT Act underlying individual rulings issued to date with respect to fuel cards was repealed. Therefore, the rulings became invalid and no longer protect the applicants. This was also confirmed by the Ministry of Finance in the information it published. At the moment, only compliance with the general ruling guarantees protection of tax settlements.

Should you have any questions or doubts regarding the issues discussed here, we are ready to assist you.

KONTAKT

E: elzbieta.lis@pl.Andersen.com

T: +48 32 731 68 58

M: +48 664 948 038

E: aleksandra.kalinowska@pl.Andersen.com

T: +48 22 690 08 70

M: +48 724 440 693